January Alt Data Roundup: Industry Launch Blitz Kicks Off 2026

New launches, products, stand out fund performance and insights from January.

BattleFin Discovery Day Miami was a massive success with attendance up 20% vs last year. We had 12 NEW data provider launches, many new product launches (Including BattleFin's Alt Data Consensus which is set to become the Benchmark for alternative data) and the release of the Exabel 2026 Buy-side Research report. Now on to the BattleFin Hong Kong Roadshow on March 19th and the BattleFin NYC on May 14th aboard the Intrepid aircraft carrier.

Plus, don't miss registering for our upcoming BattleFin Live webinar this Friday February 6th at 10am: Alt Data Driven Earnings signals & Top Takeaways from BattleFin Miami.

Buy Side Performance & News

According to a report by HFR, global hedge fund assets have exceeded $5T for the first time driven by performance and sustained investor inflows.

According to data firm SS&C, hedge fund redemption activity dropped to its lowest level in five years in January.

Hedge funds sharply reduced their bullish exposure to silver in late January, cutting net-long positions to the lowest level in almost two years as sentiment towards precious metals deteriorated ahead of a steep market sell-off, according to CFTC data. This probably drove the selloff in Gold and Silver last week.

Global hedge fund investors are renewing interest in China-focused strategies after several years of heavy outflows, according to a report by Bloomberg

Hiddenite Capital Partners, posted a 102% net return in 2025, marking its second straight year of triple-digit gains following a nearly 120% gain in 2024 according to a report by Institutional Investor

Lucida Capital - the one man hedge fund - posted a 65% gain from April to Dec 2025, outperforming larger Canadian rivals by investing primarily in mid-cap US and Canadian stocks, leverage free, according to Bloomberg.

According to a survey by Bloomberg, Quantitative investment teams are placing increasing emphasis on sector- and industry-specific datasets as artificial intelligence becomes more deeply embedded in research workflows.

SurgoCap Partners has grown assets to approx $6B, just three years after launching - marking one of the fastest-scaling hedge fund launches in recent years.

H2O Asset Management (H2O AM) has launched Generative Global Macro, an actively-managed discretionary global macro fund that integrates generative AI tools to support behavioural finance analysis and enhance portfolio decision-making.

TCI Fund Management generated an estimated $18.9B in trading gains for 2025, setting a new industry record, overtaking the previous high by Citadel in 2022.

Zhejiang High Flyer Asset Management, the quant fund founded by DeepSeek creator, delivered returns of nearly 57% in 2025, reinforcing a standout year for China’s systematic managers.

Macro hedge fund manager Said Haidar delivered a dramatic year-end turnaround for his Haidar Jupiter Fund, posting an estimated 20.3% gain in December – the largest monthly advance in over two years – and ending 2025 up 6.8%.

Bridgewater Associates’ flagship Pure Alpha fund posted a standout 33% gain in 2025, marking it one of the strongest years in the firm’s 50-year history.

According to a report by Bloomberg, Jain Global delivered a modest 3.7% net gain in 2025, marking its first full year of trading following one of the largest hedge fund launches in recent years.

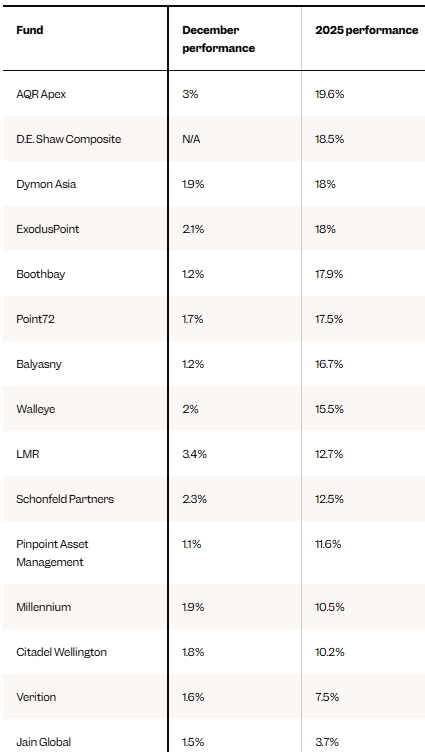

According to a report by the Financial Times, Multi-strategy hedge fund majors Millennium Management and Citadel delivered double-digit returns in 2025, rebounding from a weak start to the year.

Hunterbrook Capital, the journalism-powered hedge fund launched less than two years ago, generated a 23% net return in the first nine months of 2025, outperforming hedge fund benchmarks and equity markets as its strategy evolved beyond short selling.

Squarepoint Capital has provided a $200m anchor investment to a newly launched hedge fund, Hong Kong-based Invictus Investment Partners.

According to Goldman Sachs, Quant Hedge funds began 2026 under pressure with crowded positions in US equities, triggering the sector’s worst drawdown since Oct 2025 and reigniting concerns over volatility in systematic strategies.

Roscommon Analytics, a Houston based hedge fund, is shutting its US natural gas trading desk following losses linked to volatile energy markets, according to a report by the Financial Post.

Conductor Capital, a London-based commodity-focused hedge fund founded in 2022, is set to close following a difficult period for parts of the energy and commodities trading sector. According to data from HFR, hedge fund startups are increasingly turning to large anchor investors and separately managed accounts as a way to survive in a market dominated by multi-strategy giants.

THE DATA CORNER

Launches & Industry News

LSEG launched Trading Flow, which turns real-time order book data into long-term alpha. Trading Flow, powered by LSEG’s trusted data universe and Exponential Technology’s AI capabilities, processes millions of trades to identify investor types and strategies that give clients access to institutional grade flow intelligence. Trading flow has deep history and coverage across multiple asset classes.

PostSig launched Data Scout at BattleFin’s Discovery Day Miami, a new product designed to close one of the most persistent gaps in alternative data: the disconnect between data discovery and real execution.

Chata.ai announced closing of a $10M Series A to expand their Deterministic AI and Serlf Service Analytics offerings for TradFi, DeFi and WealthTech

Sequentum released a new MCP tool, enabling teams to manage and operate web data agents directly through AI assistants like ChatGPT and Claude.

HanKyung Aicel launched Korea Generative AI Spending Data that captures transactions for Gen AI services, enabling analysis of market size, growth and subscription behavior across individual and corporate segments. Coverage includes ChatGPT, Gemini, Claude, Perplexity, Midjourney, Wrtn and Solar.

TAC INDEX's weekly 75 global air cargo route indices will be moving to DAILY in mid-February. Air Cargo indices based on actual transactions have NEVER been published daily before, and we anticipate this important input's impact to increase correspondingly.

Financial AI announced availability of their Forecasts product on FactSet giving institutional investors seamless access to forward-looking fundamental insights directly within their existing research workflows.

BABBL Labs launched YouTube Tripwire for discretionary investors and researchers - a near real-time monitoring for an investor’s own list of companies, executives or brands.

LSEG’s Global Macro Forecasts leverage cutting-edge indicators and novel real-time macro data sources to provide forecasts weeks ahead of official government announcements with a high degree of accuracy.

New Research & Insights

Prosper Insights and Analytics released a special report comparing Prediction Markets to Consumer-Driven Economic Forecasts. With prediction markets such as Kalshi and Polymarket increasingly in the spotlight, the free report and related podcasts draw a sharp distinction between market-based probability aggregation and data-driven forecasting models grounded in consumer intent and behavior.

Advan published a report on Apple’s Q4 performance showing the firm as the primary beneficiary of an intensely competitive U.S. wireless market during the holiday quarter. Strong demand for the iPhone 17 and related product launches drove a meaningful acceleration in Apple store foot traffic and retail performance.

Two Key Takeaways:

Apple is monetizing carrier competition: Elevated churn and aggressive handset subsidies among Verizon, AT&T, and T-Mobile are transferring economic value to Apple. Carriers bear higher equipment costs to win/retain subscribers, while Apple captures the premium hardware revenue and market share gains.

Apple is crowding out broader consumer electronics retail: With >200 bps share gains and stronger average check growth (+7% at Apple stores vs. declines at Best Buy), Apple’s holiday strength diluted sales at traditional electronics retailers. The competitive wireless cycle appears likely to extend this dynamic into 2026.

Sensor Tower published a report on the state of mobile industry which shows continued traction of Gen AI, increasing focus on monetization and users spending 5.3 trillion hours on apps.

UPCOMING EVENTS

Subscribe to our newsletter to receive our BattleFin Data Round Up each month.